Happy Holidays Everyone! 🎄 What better way to mark the new year than a double issue on financial instruments in urban development & city planning?

As in most complex approaches the financial aspect has important consequences to the sustainability and practicality of city-making. In most of the developing world transition to democracy entailed rushed development. This meant that in numerous cases local governments were unable to develop the appropriate infrastructure in a timely manner. In a number of countries this has resulted in underserved communities. This is especially relevant to entities which saw considerable rural to urban population movement after the financial and political changes of the 1990s.

Most local governments struggle to keep up with current infrastructure capital expenditures and maintenance, let alone making up for the decades-old inherited infrastructure-debt. A question then arises: how can cities distribute the costs of infrastructure in a fair and equitable manner. The last decades have seen interesting models in how local authorities can use innovative financial instruments. In principle, local taxes should be easy to administer, should be levied upon local residents and should not compete with regional or central government fiscal instruments.

This first issue of this two-part series on financial instruments in development and planning will review development charges, conditioned construction density, value-based property taxes and tax increment financing. It will also tap on my personal experience in providing relevant case studies from the city of Tirana for some of these instruments. Next week I will go over business/tourism improvement districts, public private partnerships, special assessment districts, betterment fees and municipal development authorities.

DEVELOPMENT CHARGES

Development charges or Infrastructural Impact Fees charge one-off fees to targeted new development. These are usually charges that are designed to partially or fully cover public infrastructure costs related to the new development. These charges can also be directly transferred to municipal general revenues and provide income for public capital expenditures throughout a city. Development charges have become popular in cities all around the world as an efficient and politically savvy way to fill the public purse. Development charges are regressive in that not only the value of the new development but also the value of existing homeowners in the area will passively increase as a consequence of expected infrastructure investment. Ideally the charge would be earmarked to specific public infrastructure investments around the area where the tax is collected. Furthermore it would be important to embed some flexibilities to the charge with social exemptions and waivers allowing local governments to incentivize desired development typologies - for example lowering the rate in more troubled neighborhoods could be an incentive to steer development towards it.

Tirana Case Study

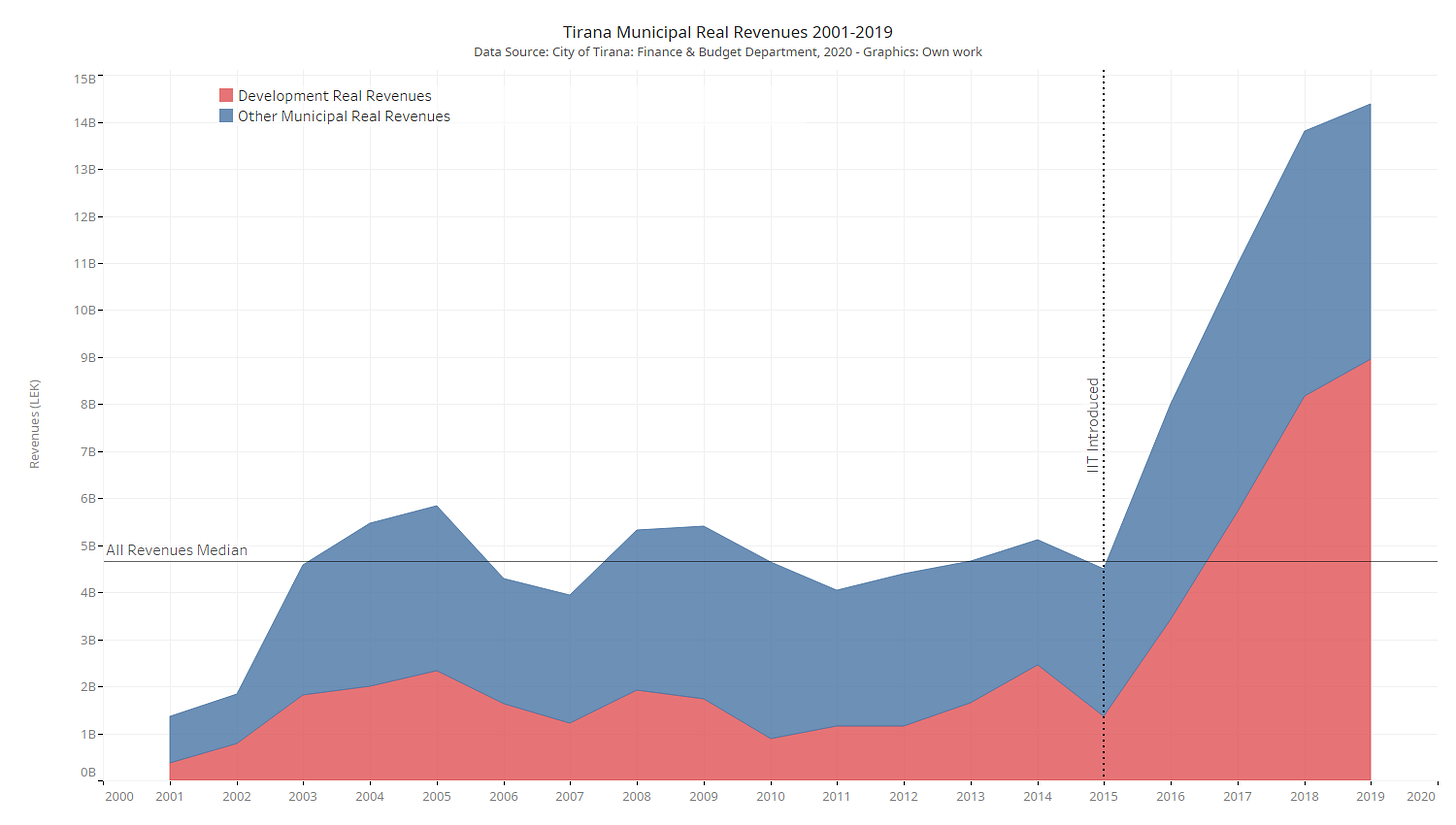

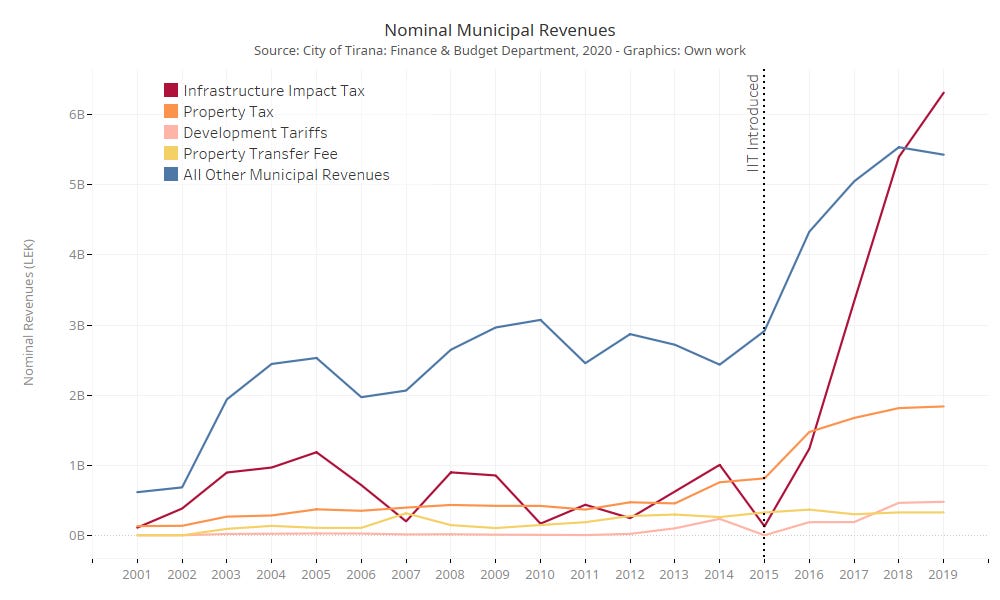

The construction industry in Tirana has been going through five booming years with residential real estate being the driving force behind the growth. Fortuitously for municipal finances, the construction boom coincided with a radical revision of the Infrastructural Impact Tax (IIT). Controlling for inflation, real revenues from development have more than tripled — with property and development-related revenues growing more than five-fold. The Infrastructural Impact Tax (IIT) is an ad-valorem tax that allows municipalities to charge an upfront fee on residential multi-family dwellings. The central government gives some degree of flexibility to the local authorities: in Tirana the IIT can be set by the city on a range of 4% - 8% of the expected minimum market price of new speculative residential development. The tax is doubled for commercial spaces and is set at 70% for underground parking and other facilities. The minimum market price is calculated from the central government as the fiscal minimum of one square meter of residential property.

Tirana Municipal Real Revenues 2001-2019 making evident the marked impact of the Infrastructure Impact Tax

CONDITIONED CONSTRUCTION DENSITY

Conditioned Construction Density (CCD) enables developers to build at a greater density in designated areas. In order for developers to access extra density, they need to fulfill certain conditions. Conditioned density can be used in order to provide public amenities, public infrastructure, or to improve the quality and sustainability of the development. This instrument is very useful in incentivizing city-wide social housing provisions. Allowing municipalities to condition density on the provision of social housing units creates a distributed network of social housing stock with little to no cost to municipal coffers. CCD needs to have clear and transparent conditions in order to avoid arbitrariness and abuse.

Tirana Case Study

In Tirana Conditioned Construction Density is sometimes used to provide public amenities. Limited amounts of extra density are released to developments in exchange for public amenities. The city uses these spaces as social housing, municipal health clinics, municipal service providers etc.

VALUE BASED PROPERTY TAXES

Property taxes are the bread and butter of most local governments providing a stable and predictable source of income. The IMF and the OECD suggest increasing property tax in post-crisis periods to boost growth - especially given stagnating incomes and aging demographics. Development charges can be very useful tools under stress but they are not a sustainable way to grow cities. With incomes declining and complex tax heavens increasing, land and property taxation will be a safe bet in maintaining stable municipal revenues. Most importantly, property taxes were able to resiliently weather the storm of the last financial crisis with revenues remaining stable even during the worst years in the United States. Various countries in Europe still employ regressive fixed-fee property taxes. It is paramount to note that a value-based tax is a much more efficient and progressive way to tax property. Furthermore a value-base tax allows municipalities to capitalize on their public expenditures by generating a virtuous circle of taxation and public investment: Public infrastructure investments would increase the property value of surrounding areas, which would increase the taxable base of the property tax, which would then generate more income for further public investment.

Tirana Case Study

Until mid-2018 Tirana practiced a fixed-fee property tax. This meant that every property throughout the city paid a similar fee which varied depending strictly on the size of the property. Starting in mid-2018 the central government switched to a value-based property tax. The government did not want to increase the nominal amount it was collecting from citizens immediately - therefore the tax rate is relatively low compared to most countries. While the city did not see an immediate increase in the total nominal revenues from its property tax, the composition of who was paying what share of the tax changed dramatically with more well-off neighborhoods paying much more then before and balancing the loss of revenues from lower-income neighborhoods.

TAX INCREMENT FINANCING

Tax Increment Financing (TIF) allows municipalities to pay for their public capital expenditures by capitalizing on the impact that their intervention is going to have on property values in the area. TIF is usually possible in countries with ad-valorem property taxes and in municipalities that can get direct access to credit. If a certain investment in an area of the city is expected to increase the value of properties around it, the local authority can earmark the extra property tax that will be collected in the area in the future to pay for the investment. TIF is not an added tax or a new tax per se, but rather an instrument that allows municipalities to be reimbursed the capital expenditures by the property owners that benefited from the investment.

Did you like this issue of thinkthinkthink? Consider sharing it with your network: Share

📚 One Book

Rethinking the Economics of Land and Housing by Josh Ryan-Collins, Toby Lloyd and Laurie Macfarlane\ A fantastic book dealing with the financial and economics aspects of land, land use, housing, and urban economics in general. The book is a compendium of information on these topics, dealing with the historical details of private property, criticizing the neoclassical approach to dealing with land simply as capital and delving a bit on future potential financial and fiscal approaches. It’s a bit particular and grounded in British history and examples, but still most of the topics are easily generalizable, and using the UK as a baseline works because of their idiosyncrasies and fairly complex land system. Highly recommended!

🔗 Three Links

Two-way street: how Barcelona is democratising public space by Stephen Burgen\ On going beyond pilot-projects in Barcelona’s city-wide transformation

The Year in Biology by John Rennie\ The most interesting findings in this pandemic-dominated year.

The Human Reach by Esri’s StoryMaps team\ Mapping the global scale of human activities

🐤 Five Tweets

That inconsiderate reconstruction artist has cut away the roof of our home and it's letting all the heat out! 😡

— Bob Marshall (@Rob_Marshall) December 22, 2020

Merry Christmas everyone, and here's to when we can all huddle around the fire and share great tales once again. Sláinte. pic.twitter.com/h58KsEqVAv

This year's @NikonSmallWorld #SmallWorldInMotion competition showcased everything from a developing zebrafish embryo to active neurons firing within a rat's brain. Let's take a look at some of the incredible imagery from this year and years past. 👇 pic.twitter.com/wOo8JnfRmD

— Tech Insider (@techinsider) December 24, 2020

What are some of your favorite histories and theories of building construction and that examine issues of labor? I know the Ruskin/Morris literature; theories of "tectonics"; Viennese material; & very recent stuff by @NegroBuilding. But there must be much more out there - ??

— David Gissen (@davidgissen) December 23, 2020

Follow hundreds of thousands of reindeer as they migrate across Lapland. From the episode Santa’s Wild Home, Nature on PBS, this video captures impressive views of their epic journey to reach their feeding grounds by the coast [video: https://t.co/TPXrCJbkqW] pic.twitter.com/2O0ITRit8e

— Massimo (@Rainmaker1973) December 24, 2020

A giant barrel jellyfish the size of a human being has been spotted off the coast of Cornwall.

— The Guardian (@guardian) July 15, 2019

"I've never seen a jellyfish that size anywhere in the world," said Dan Abbott, who captured the encounter on camera. pic.twitter.com/0cH7hNgksR

This was the fifteenth issue of thinkthinkthink - a periodic newsletter by Joni Baboci on cities, science and complexity. If you really liked it why not subscribe?